A unique opportunity to make a start and complete your required NQF qualification as an agent or principal before the December 31 deadline. The Institute of Estate Agents have has arranged with iSeleSele Property Academy for IEASA members to attend a first RPL session for theses qualifications on June 10 or 11, 2011. The cost to members is R 5 500 (Excluding Vat).

Agents must attain the level 4 qualification and principals must attain the National Certificate Real Estate NQF 5, which is a management qualification with specialisation in real estate. Both can be obtained via RPL.

The training provider, iSeleSele Property Academy has been one of the fore-runners in bringing innovative products and processes to the real estate industry to comply with current regulations. All its facilitators, assessors and moderators are subject matter experts with between many years of industry experience and offer around the clock telephonic assistance to Agents and Principals alike; all living the slogan “RPL MADE EASY”.

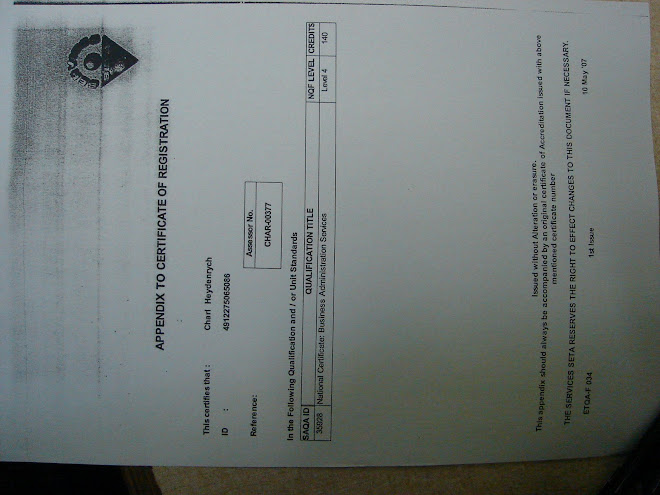

iSeleSele Property Academy has all the required accreditations and more!

• Seta Accreditation number 2283 (see www.serviceseta.org.za)

• Estate Agency Affairs Board accreditation (see www.eaab.org.za)

• Registered with the Department of Higher Education

• ISO 9001 (International standards of quality assurance issued by SABS)

Make your booking through Marian at the IEASA office – 011 431 4107, for the above dates or to be slotted into a public programme. Send her an e-mail at admin@ieasajhbmetro.co.za or fax the attached booking form to 086 669 7451

Terms: Payment by EFT into the Iselesele bank account. (See attached enrolment form).

Contact us if you have any questions regarding the training of your staff, learnerships or claiming back your skills levies.

Marian Lodewick

IEASA Jhb Metro Region

Tel: 011-431-4107

Fax: 086-669-7451

Email: admin@ieasajhbmetro.co.za

X

If you wish to submit your organisation's details go here: