Both a knowledge of FICA and the NCA are Unit Standards that need to be mastered when doing yet another government imposed requirement on entrepreneurs - FETC:Real Estate. Read this article to put things in perspective when pondering the low rate og economic growth in South Africa.

“Market Fundamentalists” – who are they? Churchill said that people occasionally stumble upon truth, but pick themselves up and press on. Josh Billings said the trouble with people isn’t their ignorance, it’s the number of things they know that just ain’t so. Ayn Rand stumbled upon something everyone knows that just ain’t so, but picked herself up and pressed on. The counter-intuitive truth she stumbled upon in her monumental novel, Atlas Shrugged, is that the world’s real “market fundamentalists” are anti-capitalists. They have more faith in capitalism than capitalists.

Rand calls entrepreneurs, “people of the mind”. Through efficient competitive enterprises these “true” capitalists create wealth. Their nemeses are “the looters”, wealth-consuming politicians, bureaucrats and hangers-on, including “crony” capitalists, beneficiaries of government patronage.

Atlas Shrugged is such a significant book that people should not be considered educated if they haven’t read it – over twenty million sold, with several readers per copy; the world’s “best novel” according to a Random House reader survey; after the Bible, the book that most affected readers’ lives according to a Library of Congress survey. Rand and millions of readers, including me forty years ago, pressed on from the truth upon which she’d stumbled.

Truth in fictionIn Atlas Shrugged, as in reality, virtually everything done by the state is characterised by incompetence, and real or suspected corruption. As in South Africa, Atlas Shrugged’s “looters” call on “the people of the mind” to help them fix their mess. They ask Rand’s capitalist heroes to run the economy as successfully as they run their businesses. But Rand’s capitalists are more than entrepreneurs, they are philosophical capitalists, so they decline and point out that the endemic failure of government isn’t the absence of competence or good faith, but the inevitable perverse incentives of interventionism.

Interventionists of all ilks regard capitalism as virtually indestructible. For pro-market liberals it is fragile – interventions and taxes subvert efficiency, bankrupt marginal business, inflict destitution and unemployment on marginal labour, and turn consumers into victims of the road to hell paved with consumer protection intentions.

In Atlas Shrugged and in reality, the anti-capitalistic mentality has an incredibly flattering conception of entrepreneurs. They believe entrepreneurs will, as if by magic, produce an endless flow of technology, products, wealth, taxes and jobs, regardless of what regulators throw at them. Instead of doing anything useful, entrepreneurs “exploit” society by way of ingenious, mysterious and nefarious stratagems. The supposed liberty of consumers and employees in free markets to decline what entrepreneurs offer, is illusory. Anti-capitalist faith in the ingenuity and indestructibility of markets is more appropriately called “market fundamentalism” than the anguished pro-market realism of free marketers. They literally believe in miracles, that capitalists can produce benefits without costs.

Free lunch fantasies

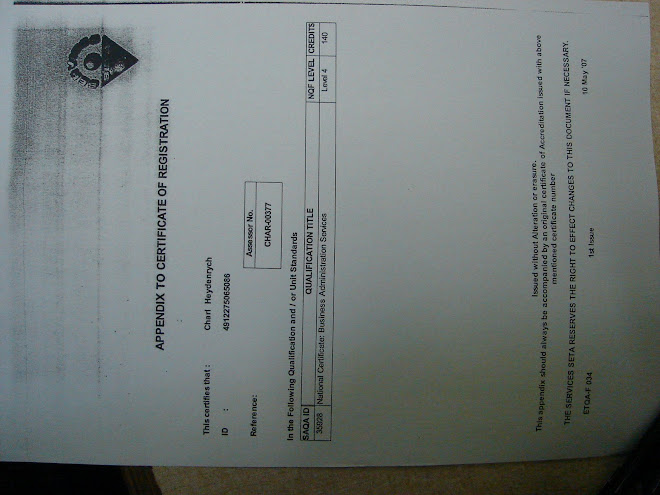

Interventionism is a grand “free lunch” fantasy whereby confiscatory taxes and incredibly costly controls, such as the Financial Advisory and Intermediary Services Act (FAIS), the National Credit Act (NCA) and a deluge of health care interventions, have no adverse impact on the provision of services, credit and health care. When economic liberals protest, interventionists have such confidence in capitalists that they cannot imagine sceptics as anything other than bad faith “fronts for big business”.

This curious confidence in capitalists explains why interventionists press on regardless of “unintended consequences”. When the disappearance of financial services for all except the rich follows FAIS, or no credit for people who need it most follows the NCA, and when none of the predicted benefits materialise, and everyone is reconciled to the characteristic incompetence of government, market liberals lament that “we told you so”, and interventionists blame “market failure”. It never occurs to them that a deluge of regulatory imposts could have negative effects, because they imagine capitalists to be God-like miracle-makers.

“Looters” often pay capitalism the ultimate compliment by imitating it. When they resort to charging for government-supplied water, supplying electricity through a state-owned company, and throw billions of Rands taxed from “people of the mind” at loss-making nationalised airlines, they call it “privatisation”, “commercialisation”, “corporatisation” “deregulation” and “PPPs”. Conversely, no one suggests improving the market by imitating government.

Instead of discontinuing failed policies, “looters” espouse increasingly extreme interventions. Failed “land reform” is what “true” capitalists expect from anti-market land policies. “Looters”, as Rand’s apt name for them predicts, not only ignore the stupendous potential for empowerment of upgrading all black-held land to freehold and redistributing the state’s superfluous land, they attribute their failure to being insufficiently Mugabeesque. Their “solution” is more of what’s failed: willing buyer-unwilling seller looting.

Gang rapeThe fundamentalist faith of “looters” in capitalism explains why they are so sanguine about increasingly extreme measures. “Organised business” responds with costly lobbying for amelioration. It achieves awkward compromises in smoke-free rooms. This gives the impression that business “supports” anti-business policies. The process is like a gang intending to gang-rape a woman responding to her pleading by deciding that she will be raped only by the gang leader. The view that business “supports” interventions amounts to saying she “agrees” to sex with her rapist. Usually “crony” capitalists negotiate regulatory threats into sufficient protection against competitors and innovators to off-set new costs and risks.

People are entitled to their own opinions, not their own facts. Whether capitalists are fearsome super-humans to be subjugated by extreme measures, or vulnerable entrepreneurs easily subverted by disincentives, is a matter of opinion. That there are no “free lunches” is a fact, which means that, notwithstanding compromises between “looters” raping markets and their victims, all interventions have costs. Whether benefits exceed costs is also a matter of fact, and the fact is that freer markets out-perform less-free markets by every objectively indexed criterion.

Author:

Leon Louw is the Executive Director of the Free Market Foundation. This article may be republished without prior consent but with acknowledgement to the author. The views expressed in the article are the author’s and are not necessarily shared by the members of the Foundation.