BUYER TIPS

Applying for a Home Loan

LIST OF INFO NEEDED

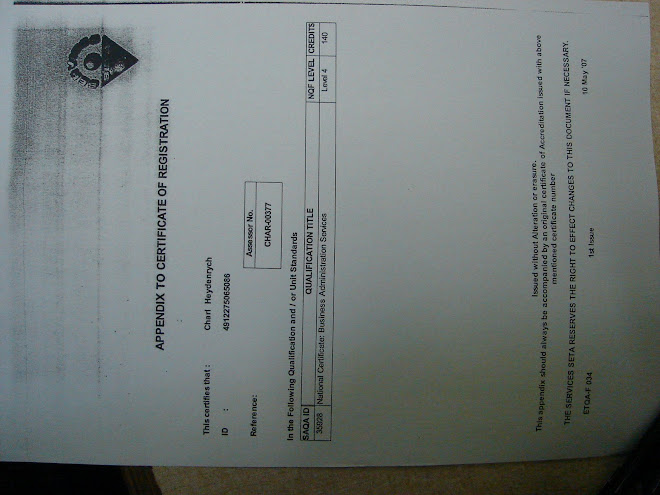

Copy of ID (If you are married IN Community of Property you need both spouses ID’s)

Marriage Certificate

Offer to Purchase

Employment Details

Proof of income:

Salaried earner – copy of latest payslip

Salaried earner (basic & Commission) – 6 months payslips -

Commission only – 6 months payslips & 6 months bank statements

Self Employed – 6 months personal bank statements. Letter from the auditor to confirm monthly drawings and audited set of financial statements.

3 months Bank Statements.

A list of ASSETS and LIABILITIES

Monthly Expenses and Income

Not that your relationship with the tax man is any of their business the banks may ask for latest SARS assessment

If property is under sectional title, copy of the financials from the body corporate and name of the managing agent

The National Credit Act which came into effect on 1 June 2007 has forced the financial institutions to be more meticulous when assessing your bond application. They have to make 100% sure that you can afford to pay the bond every month. If it can be proved that the bank has "recklessly" granted you a bond the bank may be liable and could face a fine from the Credit Regulator.

How much do you qualify for?:

The Banks base their bond approvals on your TOTAL disposable income. This means they deduct tax and all monthly expenses (including groceries etc) from your salary and whatever is left is your DISPOSABLE income.

If you have R10000 left after all deductions per month you may qualify for a bond of about R950000. Remember, you can also apply for a bond jointly and thereby qualify for a larger bond amount.

Pringle Bay

-

Name:https://en.wikipedia.org/wiki/Pringle_Bay Google count: Date: Historic

fact: Other interesting info: Where to stay:

8 years ago

No comments:

Post a Comment